The Digital Payment Market Growth, Analysis, Size, Share, Outlook, Report, Price, Trends, Forecast 2025-2032

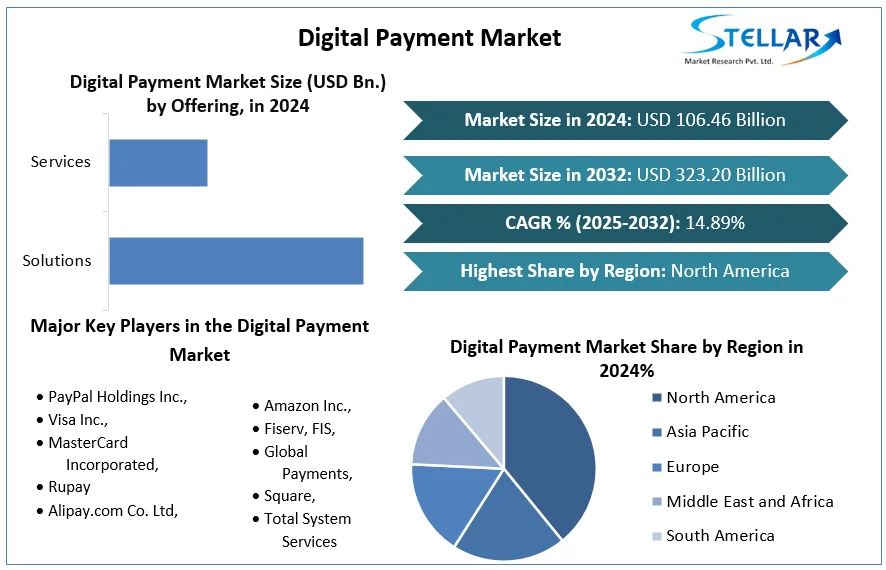

Global Digital Payment Market Set to Exceed $323 Billion by 2032, Fueled by Smartphone Surge and E-Commerce Boom

A new industry analysis reveals the global digital payment market is entering a period of transformative expansion, driven by irreversible shifts in consumer and business behavior. The market, valued at a substantial USD 106.46 billion in 2024, is projected to more than triple, growing at a robust compound annual growth rate (CAGR) of 14.89% to reach nearly USD 323.20 billion by 2032.

Purchase This Research Report at up to 30% Off @

https://www.stellarmr.com/report/req_sample/Digital-Payment-Market/1566

Market Estimation & Definition

The digital payment market encompasses the vast ecosystem enabling electronic money transfers between individuals, businesses, and entities, replacing physical cash and checks. This includes the initiation, authorization, and completion of transactions via digital devices such as smartphones, computers, and other internet-enabled platforms. The market comprises key solutions like mobile wallets (e.g., Apple Pay, Google Pay), payment gateways, peer-to-peer platforms, and supporting services like fraud detection and processing. As the backbone of the modern digital economy, it facilitates seamless, secure, and instantaneous financial interactions on a global scale.

Market Growth Drivers & Opportunity

The market's explosive growth is propelled by several interconnected megatrends. The ubiquitous penetration of smartphones and high-speed mobile networks has created a universal platform for digital transactions, making mobile payment solutions an integral part of daily life for billions. Concurrently, the COVID-19 pandemic acted as a profound catalyst, accelerating a permanent shift toward contactless transactions for safety, boosting e-commerce, and prompting government initiatives to support digital finance.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com

The Digital Payment Market Growth, Analysis, Size, Share, Outlook, Report, Price, Trends, Forecast 2025-2032

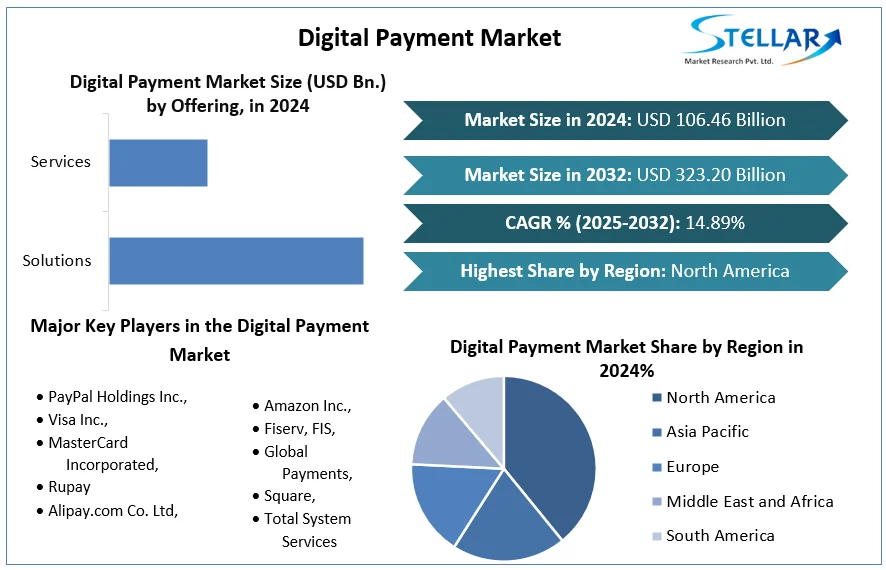

Global Digital Payment Market Set to Exceed $323 Billion by 2032, Fueled by Smartphone Surge and E-Commerce Boom

A new industry analysis reveals the global digital payment market is entering a period of transformative expansion, driven by irreversible shifts in consumer and business behavior. The market, valued at a substantial USD 106.46 billion in 2024, is projected to more than triple, growing at a robust compound annual growth rate (CAGR) of 14.89% to reach nearly USD 323.20 billion by 2032.

Purchase This Research Report at up to 30% Off @ https://www.stellarmr.com/report/req_sample/Digital-Payment-Market/1566

Market Estimation & Definition

The digital payment market encompasses the vast ecosystem enabling electronic money transfers between individuals, businesses, and entities, replacing physical cash and checks. This includes the initiation, authorization, and completion of transactions via digital devices such as smartphones, computers, and other internet-enabled platforms. The market comprises key solutions like mobile wallets (e.g., Apple Pay, Google Pay), payment gateways, peer-to-peer platforms, and supporting services like fraud detection and processing. As the backbone of the modern digital economy, it facilitates seamless, secure, and instantaneous financial interactions on a global scale.

Market Growth Drivers & Opportunity

The market's explosive growth is propelled by several interconnected megatrends. The ubiquitous penetration of smartphones and high-speed mobile networks has created a universal platform for digital transactions, making mobile payment solutions an integral part of daily life for billions. Concurrently, the COVID-19 pandemic acted as a profound catalyst, accelerating a permanent shift toward contactless transactions for safety, boosting e-commerce, and prompting government initiatives to support digital finance.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com