Asia-Pacific Sulfuric Acid Market Powers Growth: Fertilizer & Smelting Demand Fuel Surge

Market Estimation & Definition

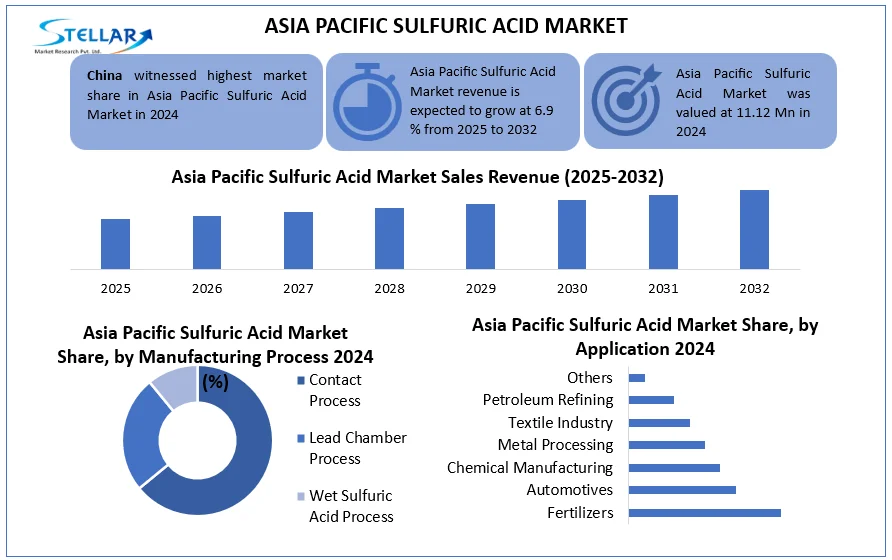

Sulfuric acid (H₂SO₄) is a dense, highly corrosive mineral acid widely used in fertilizer production, metal processing (e.g., copper, nickel, zinc), chemical synthesis, petroleum refining, and battery manufacturing. According to Stellar Market Research, the Asia-Pacific sulfuric acid market was valued at approximately USD 11.12 million in 2024 and is projected to grow at a CAGR of 6.9% from 2025 through 2032, reaching about USD 18.96 million by 2032.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/asia-pacific-sulfuric-acid-market/2718

Market Growth Drivers & Opportunities

Several powerful factors are driving the growth of sulfuric acid demand across the Asia-Pacific region:

-

Rising Fertilizer Demand

Fertilizer production is the largest end-use, consuming a major share of sulfuric acid. With expanding populations and strong government support for agriculture in countries like India and China, fertilizer demand continues to surge. This underpins a large portion of sulfuric acid consumption in the region. -

Metal Processing & Smelting Growth

A significant portion of sulfuric acid in Asia-Pacific is produced as a byproduct in base-metal smelters (e.g., copper, zinc, nickel). As electric vehicle (EV) adoption and infrastructure investments accelerate, demand for these metals is rising—and with it, sulfuric acid capacity from smelting operations. -

Chemical Manufacturing & Battery Industry

Sulfuric acid is integral to various chemical syntheses, including applications in lithium-ion battery manufacturing. The growing battery industry (for EVs, energy storage) in APAC is increasing demand for high-grade sulfuric acid. -

E-Waste Recycling as a Green Opportunity

There is a promising emerging opportunity in electronics recycling: sulfuric acid is used in hydrometallurgical processes to recover precious metals (copper, silver, palladium) from discarded electronics. As e-waste generation grows in APAC, sulfuric acid could play a pivotal role in circular-economy strategies.

What Lies Ahead: Emerging Trends Shaping the Future

Looking forward, the Asia-Pacific sulfuric acid market is likely to be shaped by these key trends:

-

Sustainable Production & Recycling: Increased emphasis on recycling smelter emissions and using acid in e-waste recovery could improve sustainability and reduce reliance on elemental sulfur feedstock.

-

Capacity Rationalization amidst Oversupply: While demand is strong, the report notes oversupply challenges. Efficient production and better balancing of supply-demand will become increasingly important.Advanced Manufacturing Processes: The dominance of the contact process (noted in the report) is expected to persist, but newer processes (e.g., wet sulfuric acid process) might gain traction for specialty acid grades. Growth of High-Purity Grades: As battery and electronics industries expand, battery-grade and reagent-grade sulfuric acid could see more demand.

-

Regulatory & ESG Focus: Environmental regulations and ESG (Environmental, Social, Governance) commitments are pushing producers to reduce emissions, optimize sulfur recovery, and possibly invest in more circular production models.

Segmentation Analysis

Based on the Stellar report, the Asia-Pacific sulfuric acid market is segmented into: By Raw Material

-

-

Elemental sulfur

-

Base metal smelters

-

Pyrite ore

The base metal smelters segment dominates because a large share of sulfuric acid in the region is generated as a byproduct from smelting.

-

-

By Manufacturing Process

-

Contact process

-

Lead chamber process

-

Wet sulfuric acid process

The contact process leads, given its efficiency and ability to produce high-purity acid. By Grade

-

-

-

Technical grade

-

Reagent grade

-

Battery grade

(The report covers these grade types and forecasts across the period.)

-

-

By Application

-

Fertilizers

-

Chemical manufacturing

-

Automotive

-

Textile industry

-

Metal processing

-

Petroleum refining

-

Others

The fertilizers segment is the largest, driven by regional agricultural demand.

-

-

By Country (Region)

The report covers major Asia-Pacific geographies such as China, India, Japan, South Korea, Australia, Malaysia, Thailand, Vietnam, Indonesia, the Philippines, and others.

Country-Level Analysis

-

China: Dominates the Asia-Pacific sulfuric acid market, thanks to its extensive base-metal smelting operations and large-scale fertilizer manufacturing. The country’s smelters generate a substantial share of the acid as a byproduct, reducing its dependence on imported sulfur.

-

India: Another significant market, driven primarily by agricultural demand and fertilizer production. The rapid expansion of phosphate fertilizer capacity supports strong sulfuric acid demand.

-

Japan, South Korea & Southeast Asia: These markets benefit from chemical manufacturing industries, battery manufacturing, and increasingly, e-waste recycling, which supports growth in more specialized acid grades.

Competitor (Commutator) Analysis

Key players in the Asia-Pacific sulfuric acid market include:

-

Jiangsu Sailboat Petrochemical Co., Ltd. (China)

-

Atotech China Chemicals Ltd. (China)

-

Hubei Center Power Technology Co., Ltd. (China)

-

Sumitomo Chemical Co., Ltd. (Japan)

-

Mitsubishi Gas Chemical Co., Inc. (Japan)

-

Coromandel International Ltd. (India)

-

DMCC Speciality Chemicals Ltd. (India)

-

NES Materials (South Korea)

-

Korea Zinc Co., Ltd. (South Korea)

-

Sun Metals Corporation Pty Ltd. (Australia)

-

SPCI HELM (Malaysia)

-

Malaya Acid Works Sdn. Bhd. (Malaysia)

-

Siam Chemicals Public Company Limited (Thailand)

-

Aureole Mitani Chemical & Environment, Inc. (Vietnam)

-

PT Indonesian Acids Industry (Indonesia), and more

These companies compete by scaling production capacity, optimizing byproduct recovery (especially from smelters), improving manufacturing efficiencies, and capturing growth in fertilizer and battery sectors. Strategic partnerships (for instance, joint ventures in acid terminals) are also strengthening their positions.

Press-Release Conclusion

The Asia-Pacific sulfuric acid market is entering a period of sustained growth, underpinned by surging demand from fertilizer production, base-metal smelting, and emerging applications such as battery manufacturing and e-waste recycling. With the market projected to grow from USD 11.12 million in 2024 to nearly USD 18.96 million by 2032 at a 6.9% CAGR, there is ample opportunity for both legacy chemical producers and new entrants. As competition intensifies, sustainability, process innovation, and strategic partnerships will be key differentiators. The increasing importance of circular economy practices—especially in countries like China and India—may further drive widespread adoption of sulfuric acid in green applications, reinforcing its role as a critical industrial chemical in the decades to come.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com