Automotive Smart Antenna Market Outlook (2024–2030)

Market Overview

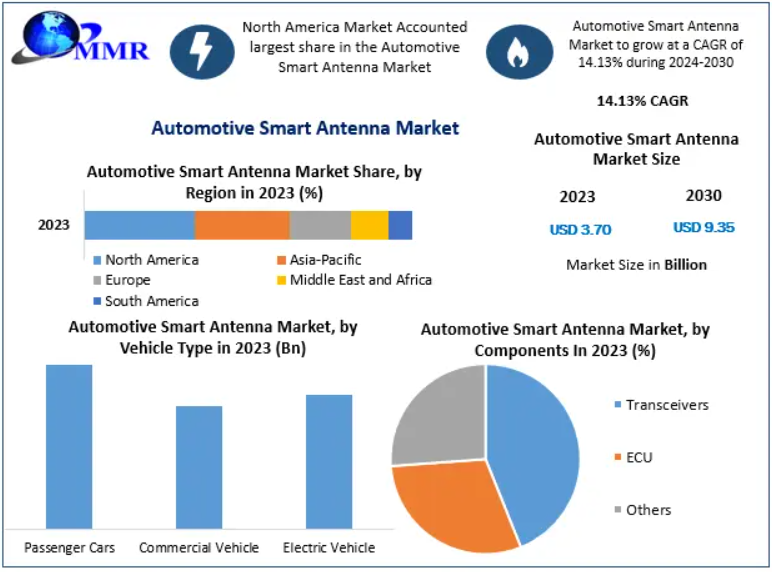

The Automotive Smart Antenna Market was valued at USD 3.70 billion in 2023 and is projected to reach USD 9.35 billion by 2030, expanding at a CAGR of 14.13% during the forecast period.

Automotive smart antennas are advanced communication systems that enable seamless connectivity by integrating services such as GPS, Wi-Fi, Bluetooth, 3G/4G/5G mobile communication, e-Call, and broadcast radio/TV into vehicles. Unlike traditional antennas, which rely on multiple cables and external devices, smart antennas consolidate various functions, reducing signal loss and enabling efficient vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication.

These antennas are now recognized as vital components of connected and autonomous vehicles, playing a key role in enhancing safety, security, navigation, and infotainment.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/70933/

Market Dynamics

Key Growth Drivers

-

Rising demand for connected and intelligent vehicles

Growing consumer demand for in-vehicle infotainment, navigation, and communication features is driving adoption. Smart antennas support real-time data exchange, essential for autonomous driving and telematics. -

Expansion of electric vehicles (EVs)

EVs integrate advanced communication systems for energy management, infotainment, and safety. As EV adoption accelerates in North America, Europe, and Asia-Pacific, the demand for smart antennas is projected to grow significantly. -

Integration of multiple services into a single module

Automotive smart antennas provide GPS, mobile connectivity, emergency call systems, and wireless access without requiring separate modules, reducing hardware complexity and cost.

Restraints

-

Infrastructure limitations: Insufficient ICT infrastructure in emerging economies can restrict market penetration.

-

Data management challenges: Handling vast amounts of communication and signal data poses technological complexities for manufacturers.

Opportunities and Trends

-

Adoption of MIMO antenna technology: Multiple-input and multiple-output (MIMO) systems are being increasingly used in vehicles to improve signal quality, enhance connectivity, and support 5G networks.

-

Growing EV penetration: As hybrid and fully electric vehicles become mainstream, they create opportunities for expanded connectivity features.

-

Rising comfort and safety expectations: Features such as digital audio/video broadcasting, enhanced GPS services, and telematics systems are boosting demand for smart antennas.

Segment Analysis

By Frequency

-

High frequency

-

Very high frequency

-

Ultra-high frequency – fastest-growing segment due to 5G adoption.

By Vehicle Type

-

Passenger Cars – dominate the market owing to high adoption of infotainment and connectivity features.

-

Commercial Vehicles – growing demand for fleet telematics and logistics optimization.

-

Electric Vehicles – fastest-growing segment, supported by EV integration of smart communication systems.

By Component

-

Transceivers

-

ECU (Electronic Control Unit) – largest segment, enabling signal processing and communication control.

-

Others

By Sales Channel

-

OEM (Original Equipment Manufacturer) – leading due to direct integration into new vehicles.

-

OES (Original Equipment Supplier) and IAM (Independent Aftermarket) are growing, driven by retrofitting and upgrades.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/70933/

Regional Insights

-

Asia-Pacific: Expected to register the highest growth rate, led by China, Japan, South Korea, and India. Factors include strong economic growth, rapid urbanization, and government regulations supporting connected car technologies.

-

North America: Growth driven by early adoption of EVs, connected cars, and strong presence of key automotive OEMs.

-

Europe: Dominated by advanced automotive manufacturing hubs such as Germany, the UK, and France, with strict safety and emission regulations fostering smart antenna adoption.

-

Middle East, Africa, and South America: Emerging markets with rising vehicle demand, though limited ICT infrastructure remains a barrier.

Competitive Landscape

The market is moderately fragmented, with established players focusing on innovation, strategic partnerships, and new product launches. Competition is driven by the need for high-performance connectivity and cost-efficient designs.

Key Players include:

-

Continental AG

-

TE Connectivity

-

Denso Corporation

-

Harman International (Samsung Electronics)

-

Kathrein Automotive GmbH

-

Yokowo Co., Ltd.

-

Hella GmbH & Co. KGaA

-

Mitsubishi Electric Corporation

-

Valeo S.A.

-

LG Innotek

-

Amphenol Corporation

-

Ficosa International S.A.

-

Antenova Ltd.

-

MD Electronik GmbH

-

Schaffner Holding AG

-

Laird Connectivity

-

Harada Industry Co., Ltd.

Recent Developments

-

Airgain, Inc. launched a series of multi-band LTE and fleet antennas (2018–2019) including OptumX and CENTURION, expanding its portfolio for high-performance automotive connectivity.

-

Hirschmann/TE Connectivity introduced its Remote Tuner Module, advancing vehicle radio technologies.

-

HELLA partnered with BHAP to supply electronic components under HELLA BHAP Electronics Co., Ltd.

Market Outlook

The automotive industry is undergoing a connectivity revolution, with smart antennas at its core. By 2030, the market will nearly triple, fueled by EV adoption, 5G deployment, autonomous driving technologies, and rising consumer demand for digital experiences.

Automotive smart antennas are evolving from being auxiliary components to becoming central communication hubs, enabling the transition to smarter, safer, and more connected mobility ecosystems.