For small business owners, managing finances can be both time-consuming and expensive. Outsourcing bookkeeping offers a practical solution to these challenges, enabling businesses to streamline operations while reducing costs. Here’s how outsourcing bookkeeping can help small businesses thrive, drawing insights from KMK Ventures and industry trends.

What Is Outsource Bookkeeping for Small Business?

Outsourcing bookkeeping involves delegating financial recordkeeping and transactional tasks to external experts instead of handling them in-house. This can include invoicing, bank reconciliations, payroll management, expense tracking, and generating financial reports.

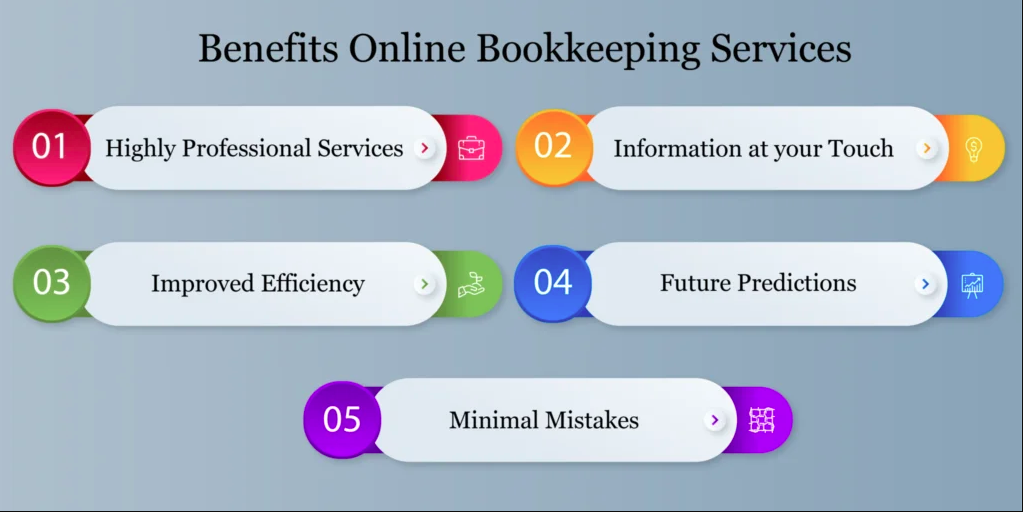

Key Benefits of Outsourcing Bookkeeping for Small Businesses

1. Cost Reduction and Predictable Expenses

Hiring a full-time bookkeeper or accountant involves salaries, benefits, taxes, and overhead costs. Outsourcing allows small businesses to pay only for the services they need, often resulting in cost savings of 40% to 60% compared to in-house hiring. This flexible pricing fits fluctuating workloads and budgets.

2. Increased Operational Efficiency

Outsourced bookkeeping firms use advanced software and automation tools, bringing speed and accuracy to financial tasks. Dedicated professionals maintain up-to-date records, freeing internal teams to focus on growth and customer service instead of manual bookkeeping.

3. Access to Specialized Expertise

Professional bookkeeping services provide access to skilled experts knowledgeable in compliance, tax regulations, and industry best practices. This expertise reduces errors and ensures financial accuracy, which is crucial for making informed business decisions.

4. Enhanced Financial Security

Reputable bookkeeping providers use secure cloud platforms with encryption and backup systems, safeguarding sensitive financial data better than many small businesses could in-house.

5. Scalability and Flexibility

Outsourcing services can scale according to business needs—offering more support during growth phases and less during slower periods. This adaptability prevents the complexity and cost of adjusting in-house resources.

Common Questions About Outsource Bookkeeping

How quickly can outsourcing improve my business operations?

Outsourced bookkeeping firms typically provide timely, often daily, updates and reports, improving financial clarity and enabling faster, data-driven decisions.

Is outsourcing bookkeeping secure and reliable?

With stringent data security protocols and certified professionals, outsourcing can provide highly reliable and safe financial oversight.

Will outsourcing limit my control over business finances?

No—effective communication and regular reporting ensure business owners remain fully informed and in control while delegating routine bookkeeping tasks.

Conclusion

Outsourcing bookkeeping is a smart strategy for small businesses aiming to reduce costs, improve accuracy, and boost operational efficiency. It allows business owners to focus on growth and customer satisfaction while benefiting from expert financial management. For those looking to explore trusted providers and detailed services, KMK Ventures offers comprehensive outsourced accounting solutions tailored for small and growing businesses.