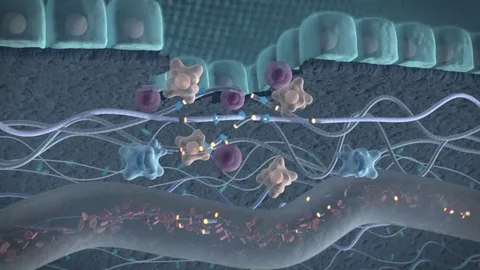

The global Biomarker Discovery Market is rapidly emerging as a foundational pillar in the evolution of modern healthcare and drug development. Biomarker discovery refers to the identification, validation, and deployment of biological indicators such as genes, proteins, metabolites, and other molecular signatures that can provide critical insight into disease onset, progression, therapeutic response, and patient stratification. As precision medicine takes centre stage, pharmaceutical and biotechnology companies increasingly rely on robust biomarker discovery to streamline drug development pipelines, optimize clinical trial outcomes, and enable diagnostics based on molecular profiling. In short, the biomarker discovery market is not just about finding markers it’s about unlocking personalized care and more efficient therapeutics.

Download Exclusive Sample Report: https://www.datamintelligence.com/download-sample/biomarker-discovery-market?juli

According to DataM Intelligence, the biomarker discovery market reached a value of US $17.84 billion in 2023 and rose to US $19.80 billion in 2024. The forecast points toward a market size of approximately US $54.19 billion by 2033, representing a compound annual growth rate (CAGR) of about 11.9% across the 2025-2033 timeframe. Key growth drivers include the rising adoption of next-generation sequencing (NGS), mass spectrometry and multi-omics platforms; the expanding footprint of companion diagnostics; the need for improved therapeutic efficacy and safety; and the surge in chronic and complex diseases requiring molecular insight. Among product segments, consumables dominate (owing to recurring reagent use in biomarker workflows), and geographically, North America leads the market thanks to its mature biotechnology ecosystem, strong research infrastructure, significant R&D spend, and favourable regulatory environment.

Key Development:

United States: Recent Industry Developments

The U.S. biomarker discovery market has been the locus of significant industry activity, driven by acquisitions, strategic partnerships, and technology launches. For example, a major genomics firm acquired a proteomics-driven biomarker discovery company to deepen its multi-omics capabilities.

Another development saw a prominent contract research organisation (CRO) announce a large-scale proteome-wide study involving thousands of samples, incorporating artificial intelligence (AI)-driven analytics to identify early-onset cancer markers. These moves signal a shift toward integrated platforms that combine genomics, transcriptomics, proteomics and AI. The effect: faster biomarker identification, reduced time-to-clinical validation and deeper collaboration between pharmaceutical companies and biomarker-technology providers.

Japan: Recent Industry Developments

In Japan, the biomarker discovery market is also gaining momentum. Japanese regulatory bodies have granted approvals for next-generation genomic profiling tests, expanding access to biomarker-based diagnostics and enabling broader biomarker discovery programmes. Meanwhile, Japanese biopharma firms have opened dedicated biomarker research centres in Tokyo and Osaka, often in partnership with global technology vendors, to accelerate biomarker screening and validation for personalized medicine. These developments reflect Japan’s strategic push to enhance its precision medicine ecosystem by linking domestic research with global biomarker innovation networks.

Key Players

The biomarker discovery market features a competitive landscape composed of leading biotech, life-science equipment, reagent, and service companies. Among the major names are:

• Thermo Fisher Scientific Inc.

• Illumina, Inc.

• Agilent Technologies, Inc.

• Bio-Rad Laboratories, Inc.

• Merck KGaA

• Hoffmann-La Roche Ltd.

• Abcam Limited

• Olink

• SomaLogic

• BD (Becton, Dickinson and Company)

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=biomarker-discovery-market

Growth Forecast Projected

Looking ahead, the biomarker discovery market is expected to accelerate, driven by expanding applications across diagnostics, drug development, and personalized medicine. Between 2025 and 2033, the market is projected to grow at a strong CAGR of approximately 11.9%, moving from roughly US $20 billion toward US $54 billion. This forecast reflects both broadening adoption (as more diseases and therapy areas integrate biomarkers) and deepening spend per study (as technologies become more complex and multi-dimensional). The growth is particularly strong in developed markets but emerging geographies (Asia-Pacific, Latin America) are gaining traction, thereby contributing increasing incremental growth. Moreover, the rising need for biomarkers in immuno-oncology, neurodegeneration and rare diseases further propels the forecast.

Research Process

The methodology underlying the market forecast is comprehensive and rigorous. It combines both primary and secondary research sources. Primary research involves interviews and discussions with key stakeholders such as biomarker service providers, pharmaceutical R&D leaders, diagnostic companies and academic research institutions to understand market dynamics, technology adoption, pricing models and growth constraints. Secondary research includes analysis of annual reports, regulatory filings, published journal literature, trade databases, and market intelligence platforms. Data points such as historic revenues, growth rates, segment share, product launches, and regional trends are triangulated and validated. The research process also factors in macro-economic parameters, healthcare policy changes, disease prevalence statistics and technology trends to build robust projections.

Get Customized Report as per your Business Requirements: https://www.datamintelligence.com/customize/biomarker-discovery-market?juli

Key Segments

The biomarker discovery market can be dissected across several major segmentation categories, helping organisations target their strategy and investment.

By Product Type:

-

Consumables (reagents, assay kits, microplates)

-

Instruments (sequencers, mass spectrometers, imaging systems)

-

Software & Services (bioinformatics platforms, data analytics, contract research services)

By Technology:

-

Genomics (NGS, whole-genome sequencing, gene panels)

-

Proteomics (mass spectrometry, protein arrays)

-

Metabolomics

-

Transcriptomics

-

Epigenomics

-

Lipidomics

-

Others (e.g., glycomics, microbiome biomarkers)

By Application:

-

Drug Discovery & Development (target identification, biomarker screening)

-

Diagnostics (companion diagnostics, prognostic biomarkers)

-

Personalized Medicine (patient stratification, therapy monitoring)

-

Others (biomarker validation, translational research)

By End-User:

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organisations (CROs)

-

Academic & Research Institutes

-

Diagnostic Laboratories

-

Hospitals & Clinics

-

Others (service providers, government labs)

This segmentation underscores multiple growth vectors: consumables that deliver recurring revenue, instruments that require large capital investments, and software/services that scale with data complexity. Technologies such as genomics continue to hold leading share but proteomics and metabolomics are expected to grow especially fast as integrative, multi-omics approaches become the norm.

Benefits of the Report

The report offers a comprehensive toolbox for decision-makers and stakeholders looking to position themselves effectively in the biomarker discovery market:

-

A clear and validated market size and forecast (2023 through 2033) for strategic planning.

-

In-depth segmentation analysis enabling stakeholders to identify high-growth sub-markets (by product, technology, application, end-user).

-

Regional and country-level dynamics, revealing which geographies are ready and which hold untapped potential.

-

Competitive landscape mapping, including major player strategies, product portfolios and recent developments.

-

Insight into technology trends how genomics, proteomics, metabolomics, AI and multi-omics interplay within the biomarker discovery ecosystem.

-

Identification of key growth drivers (precision medicine, regulatory support, disease burden) and constraints (cost, complexity, reimbursement).

-

Detailed forecasting models with customizable inputs to support investment or business expansion decisions.

-

Supply-chain and ecosystem analysis how reagents, instruments, data analytics, service providers interconnect.

-

Strategic recommendations for entering emerging markets or extending service portfolios in mature markets.

-

Support for M&A, partnership decisions, go-to-market planning, and R&D investment prioritisation.

Conclusion

The biomarker discovery market is charting a decisive trajectory toward becoming a multi-billion-dollar global opportunity, powered by the convergence of advanced technologies, growing demand for personalized therapies and diagnostics, and the relentless drive of pharmaceutical and biotech companies to reduce time-to-market. Organisations making the right strategic moves now whether investing in consumables, instruments, data platforms or services stand to benefit significantly.