Blockchain Insurance Market 2024-2030: Transforming Insurance with Decentralized Technology

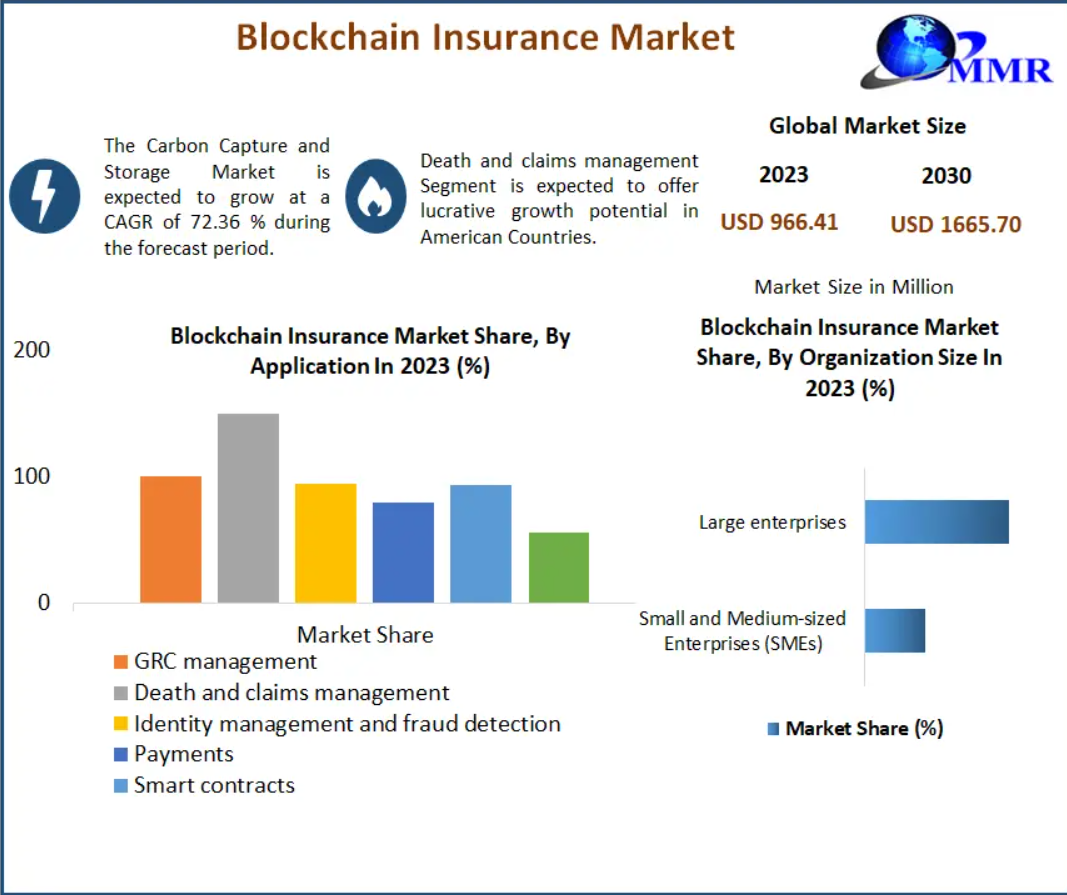

The Global Blockchain Insurance Market was valued at USD 966.41 Million in 2023 and is projected to grow at an astonishing CAGR of 72.36%, reaching approximately USD 1,665.70 Million by 2030. Blockchain technology is revolutionizing the insurance sector by offering secure, transparent, and real-time data transfer across multiple parties, enabling faster claims, reduced fraud, and greater efficiency.

Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/11489/

Understanding Blockchain in Insurance

Blockchain in insurance refers to the application of cryptographically secured distributed ledgers to store, validate, and share insurance data among stakeholders. Using smart contracts, transactions such as claims, policy issuance, and payments can be automated, reducing intermediaries, eliminating errors, and improving transparency. Blockchain also enables the entry of underinsured populations in developing markets by lowering transaction costs and enhancing reliability.

Ethereum-based smart contracts are central to these innovations, facilitating tamper-proof audit trails and real-time automation. For instance, telematics-enabled insurance can automatically initiate claims and payouts after an accident, significantly enhancing customer satisfaction.

Key Market Drivers

-

Fraud Reduction: Insurance fraud is a persistent challenge globally. Blockchain’s immutable ledger ensures accurate records of all transactions, enabling companies to detect fraudulent claims more effectively.

-

Operational Efficiency: Blockchain streamlines claims processing, policy administration, and verification, saving time and operational costs.

-

Expanding Digital Insurance Channels: In India, digital insurance platforms already account for 30–40% of policies issued, and blockchain integration promises to further boost adoption.

-

Access to Emerging Markets: By lowering costs and simplifying transactions, blockchain opens insurance services to underinsured populations, especially in developing regions.

Market Opportunities

-

BaaS (Blockchain as a Service): Large technology providers are integrating blockchain modules into cloud platforms, enabling insurers to adopt blockchain without extensive infrastructure investment.

-

R&D-Driven Innovation: Ongoing research in blockchain technology allows insurers to develop tailored products, expand use cases, and improve transaction security.

-

Dynamic Insurance Models: Blockchain enables real-time, usage-based insurance for sharing economy platforms, such as on-demand coverage for renters or ride-sharing services.

Market Trends

-

Blockchain adoption is most beneficial when multiple parties are involved, no central trusted authority exists, and transparency is crucial.

-

The initial implementation focuses on high-value processes across the insurance value chain, identifying use cases that cut costs, improve efficiency, and reduce information gaps between stakeholders.

-

Increasing interest in real-time insurance platforms enables dynamic coverage and better customer engagement.

Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/11489/

Challenges and Limitations

-

Complexity of Blockchain: Understanding distributed ledger systems and encryption remains a barrier to adoption.

-

Regulatory Uncertainty: Insurance regulations are constantly evolving, making compliance a challenge for blockchain-based solutions.

-

Technical Constraints: Limitations such as transaction speed, verification procedures, and scalability must be addressed for widespread adoption.

Market Segmentation

By Provider:

-

Application and Solution Providers: Dominant segment, offering platforms for record verification, digital identity, and fraud prevention.

-

Middleware Providers

-

Infrastructure and Protocol Providers

By Application:

-

Governance, Risk, and Compliance (GRC) Management

-

Death and Claims Management

-

Identity Management and Fraud Detection

-

Payments

-

Smart Contracts

-

Other applications, including content storage and customer communication

By Organization Size:

-

SMEs

-

Large Enterprises

By Component:

-

Solutions

-

Services

Regional Insights

-

North America: Led the market in 2023 with over 43% revenue share, driven by early blockchain adoption, skilled workforce, and widespread financial sector integration.

-

Asia-Pacific: Expected to witness rapid growth, propelled by initiatives in China and India, technological advancements, and blockchain-enabled medical and insurance services.

-

Europe: Adoption led by innovation initiatives from insurers like Allianz, Generali, and B3i, emphasizing compliance and risk reduction.

Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/11489/

Blockchain in the Indian Insurance Industry

India’s insurance sector, valued at USD 966.41 Billion in 2023, has seen significant growth driven by digital channels and regulatory encouragement. Blockchain adoption can enhance pricing efficiency, policy uniformity, and fraud mitigation, aligning with the Insurance Regulatory and Development Authority’s (IRDAI) directives.

Competitive Landscape

Key players are leveraging blockchain to deliver innovative insurance solutions:

North America: Lemonade, MetLife, AXA XL, State Farm, Liberty Mutual

Europe: B3i, Allianz, Generali, Mapfre, Swiss Re

Asia-Pacific: Ping An Insurance, Bajaj Allianz, Sompo Japan Nipponkoa, Tokio Marine & Nichido Fire, QBE Insurance

Notable Developments:

-

Sparkpool and Applied Blockchain Inc. acquired NVIDIA GPUs in 2022 to expand Ethereum mining operations.

-

Beazley launched a Directors’ & Officers’ liability insurance plan for Bitcoin enterprises in 2022.

-

Zetrix introduced blockchain-based insurance with cryptocurrency payouts, requiring only a passport and digital wallet.

Future Outlook

The blockchain insurance market is poised for transformative growth as insurers increasingly leverage decentralized technology for automation, fraud prevention, and efficiency. The market’s rapid CAGR of 72.36% highlights the potential for blockchain to reshape insurance globally, enabling faster, more secure, and transparent services across multiple sectors.