For U.S. SaaS startups, scaling fast while keeping costs under control is the ultimate balancing act. Every decision—whether about hiring, technology, or customer acquisition—can make or break growth. One area where many startups struggle is financial management. Building an in-house accounting team is expensive, and traditional bookkeeping methods can’t keep up with the pace of SaaS operations. That’s where saas outsourced accounting steps in. But what exactly is it, and why are more SaaS startups in the U.S. adopting this model in 2025? Let’s explore the key insights and benefits.

What Is SaaS Outsourced Accounting?

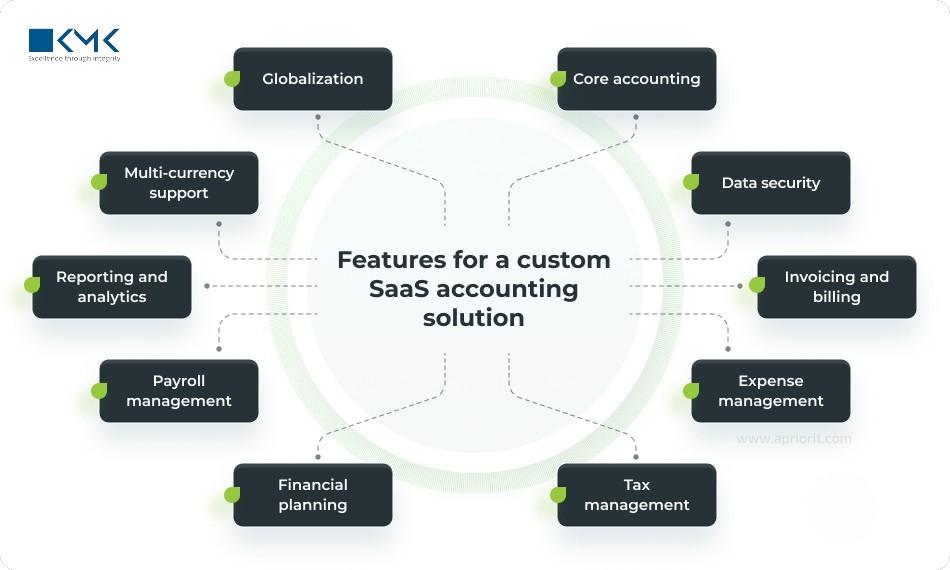

SaaS outsourced accounting blends two powerful solutions:

-

SaaS (Software-as-a-Service) Platforms: Cloud-based accounting tools that allow startups to manage finances, track revenue, and access real-time reports without building complex IT infrastructure.

-

Outsourced Accounting Services: External professionals who handle bookkeeping, payroll, tax compliance, accounts receivable (AR), accounts payable (AP), and financial reporting.

Together, this model delivers streamlined financial management for SaaS startups that need agility, accuracy, and cost savings.

Why SaaS Startups Need a Smarter Approach to Accounting

Unlike traditional businesses, SaaS startups face unique financial challenges:

-

Recurring Revenue Models: Subscriptions require tracking monthly recurring revenue (MRR), annual recurring revenue (ARR), and churn rates.

-

Rapid Scaling: Growth often happens fast, making scalability a priority.

-

Investor Reporting: Startups need accurate financial data to attract and retain investors.

-

Complex Compliance: U.S. tax rules, especially around digital products and services, can be tricky.

Handling all this with spreadsheets or outdated systems is inefficient. SaaS outsourced accounting provides startups with a solution built for modern needs.

Key Benefits of SaaS Outsourced Accounting for Startups

1. Cost Efficiency

Startups operate on tight budgets. Hiring full-time accountants and investing in expensive software drains resources. Outsourced accounting paired with SaaS tools offers professional services at a fraction of the cost.

2. Scalability with Growth

As customer bases expand, transaction volumes increase. SaaS outsourced accounting solutions scale effortlessly, whether a startup has 100 or 100,000 users.

3. Real-Time Financial Visibility

SaaS platforms provide live dashboards with key metrics—MRR, cash burn rate, and gross margin—helping founders and CFOs make faster, data-driven decisions.

4. Improved Cash Flow Management

With automated AR and AP systems, startups reduce late payments, improve collections, and maintain healthier cash reserves.

5. Compliance Without the Stress

From U.S. sales tax regulations to GAAP reporting, outsourced experts ensure that startups stay compliant, reducing audit risks and penalties.

6. Focus on Core Growth

Instead of spending time on reconciliations and tax filings, startup teams can focus on building better products, improving customer experiences, and scaling operations.

How SaaS Outsourced Accounting Works in Practice

Here’s how a U.S. SaaS startup might use this model:

-

Onboarding: Connects its existing systems (payment processors, CRM, banking apps) to the SaaS accounting platform.

-

Automation: Transactions, invoices, and payroll data sync automatically.

-

Oversight: Outsourced accountants review entries, ensure accuracy, and prepare compliance-ready reports.

-

Reporting: Founders and investors receive real-time updates on financial performance.

-

Strategic Support: Outsourced experts advise on cash flow management, forecasting, and tax planning.

This combination of automation plus human expertise makes financial operations seamless.

A Comparison: In-House vs. SaaS Outsourced Accounting

| Feature | In-House Accounting | SaaS Outsourced Accounting |

|---|---|---|

| Cost | High (salaries, benefits, software) | Lower (subscription + outsourcing fees) |

| Scalability | Limited, requires new hires | Flexible, scales with growth |

| Data Access | Office-based, limited hours | Cloud-based, 24/7 access |

| Compliance | Dependent on staff expertise | Managed by dedicated professionals |

| Focus | Internal resources split | Founders free to focus on growth |

For resource-conscious startups, the advantages of saas outsourced accounting are hard to ignore.

Common Questions from SaaS Startups

Q1: Will outsourcing mean losing control of finances?

No. SaaS platforms ensure founders have real-time visibility into every transaction, while outsourced teams handle execution.

Q2: Is this model secure?

Yes. Reputable providers use bank-grade encryption, two-factor authentication, and regular audits to protect sensitive financial data.

Q3: Can small startups benefit, or is this only for scaling companies?

Even pre-revenue startups benefit from outsourced accounting—especially for investor reporting, tax compliance, and cash flow tracking.

Why 2025 Is the Right Time for SaaS Startups to Switch

Several trends are making SaaS outsourced accounting the go-to choice in 2025:

-

Investor Expectations: Accurate financial reporting is crucial for raising capital.

-

Rising Labor Costs: In-house accounting hires are increasingly expensive in the U.S.

-

Remote Work Culture: Cloud-based platforms support distributed startup teams.

-

AI and Automation: Accounting platforms are smarter than ever, reducing errors and improving efficiency.

For startups, adopting this model early builds financial discipline and scalability from day one.

The Future of SaaS Outsourced Accounting for Startups

Looking ahead, we can expect:

-

Predictive Analytics: AI tools will forecast revenue and cash flow with greater accuracy.

-

Industry-Specific Tools: SaaS platforms designed specifically for startups in fintech, healthtech, or edtech.

-

Seamless Integrations: Accounting platforms will connect with CRMs, billing systems, and HR tools for unified reporting.

-

Advisory Roles: Outsourced accountants will act more as strategic partners than number-crunchers.

For startups aiming to scale quickly, these innovations will provide even more competitive advantages.

Final Thoughts

For U.S. SaaS startups, growth is about moving fast, making smart financial decisions, and staying compliant—all without overspending. That’s why saas outsourced accounting is becoming the model of choice. By combining cloud-based platforms with expert outsourced accountants, startups gain real-time visibility, lower costs, and the ability to scale without friction. In 2025 and beyond, the startups that thrive will be the ones that build strong financial foundations early. And SaaS outsourced accounting is proving to be the smartest way to do just that.