Fintech apps are now essential in today's digital-first economy rather than a luxury. Fintech solutions are changing how consumers and businesses deal with money, from blockchain-powered transactions to AI-driven wealth management and mobile banking. Grand View Research projects that the demand for smooth, safe, and easy-to-use financial tools will propel the global fintech market to surpass $492 billion by 2027. But creating a successful fintech app takes more than just knowing how to code; it also calls for knowledge of cutting-edge technologies, cybersecurity, and regulatory compliance. At this point, working with specialised fintech app development services becomes essential.

Why Fintech App Development Services Matter

Fintech apps bridge the gap between traditional finance and modern user expectations. Here’s why investing in professional fintech app development services is a strategic move:

- Enhanced Security & Compliance:

Financial apps handle sensitive data, making PCI-DSS compliance, encryption, and biometric authentication non-negotiable. Professional developers ensure adherence to regulations like GDPR, PSD2, and FINRA. - Personalized User Experiences:

68% of consumers expect brands to personalize financial interactions (Salesforce). AI-driven features like spending insights, tailored loan offers, and predictive budgeting keep users engaged. - Operational Efficiency:

Automate processes like KYC verification, fraud detection, and invoice management to reduce costs and errors while accelerating workflows. - Global Scalability:

Fintech apps must support multi-currency transactions, cross-border payments, and localized compliance—features that require scalable architecture. - Competitive Edge:

Stand out with innovations like robo-advisors, open banking APIs, or decentralized finance (DeFi) integrations that cater to tech-savvy users.

Must-Have Features of a Successful Fintech App

To thrive in the competitive financial sector, your app must combine robust functionality with intuitive design. Here are the features top fintech app development services prioritize:

- AI-Powered Analytics:

- Predictive budgeting tools.

- Credit scoring algorithms.

- Fraud detection using machine learning.

- Blockchain Integration:

Enable secure, transparent transactions for crypto wallets, smart contracts, or supply chain finance. - Real-Time Payment Gateways:

Support UPI, SWIFT, SEPA, and digital wallets (PayPal, Apple Pay) for instant transactions. - Open Banking APIs:

Connect with third-party financial institutions to offer aggregated account views, loan comparisons, or investment opportunities. - Robust Security Protocols:

- Biometric authentication (Face ID, Touch ID).

- End-to-end encryption.

- Behavioral analytics to flag suspicious activity.

- Personal Financial Management (PFM) Tools:

- Spending categorization.

- Savings goal trackers.

- Debt management dashboards.

- Multi-Platform Compatibility:

Ensure seamless performance across iOS, Android, and web platforms. - Customer Support Automation:

Deploy AI chatbots for 24/7 assistance with FAQs, transaction disputes, or account updates. - Regulatory Compliance:

Automate tax reporting, audit trails, and AML (Anti-Money Laundering) checks to stay audit-ready.

Why Partner with Professional Fintech App Development Services?

Building a fintech app in-house is risky without niche expertise. Here’s how specialized fintech app development services add value:

- Domain Expertise:

Developers understand industry pain points, from PCI compliance hurdles to integrating legacy banking systems. - Cutting-Edge Tech Stack:

Leverage tools like React Native (for cross-platform apps), TensorFlow (AI), Hyperledger (blockchain), and AWS (cloud security). - Agile Development:

Break projects into sprints for iterative testing, ensuring compliance and functionality at every stage. - Cost Efficiency:

Avoid hiring in-house specialists for niche tasks like blockchain development or regulatory consulting. - Post-Launch Support:

Ensure continuous updates, bug fixes, and scalability as user bases grow or regulations evolve.

Steps to Build a Fintech App That Stands Out

- Define Your Niche:

Identify your target audience—retail banking, wealth management, insurtech, or B2B payments. - Prioritize Security:

Partner with developers who prioritize ISO 27001 certification and penetration testing. - Choose the Right Features:

Balance innovation with usability. For example, a budgeting app might focus on AI-driven insights, while a crypto exchange needs blockchain integration. - Test Rigorously:

Conduct UAT (User Acceptance Testing) with real users to validate security, speed, and UX. - Launch & Optimize:

Monitor KPIs like user retention, transaction success rates, and load times post-launch.

Conclusion

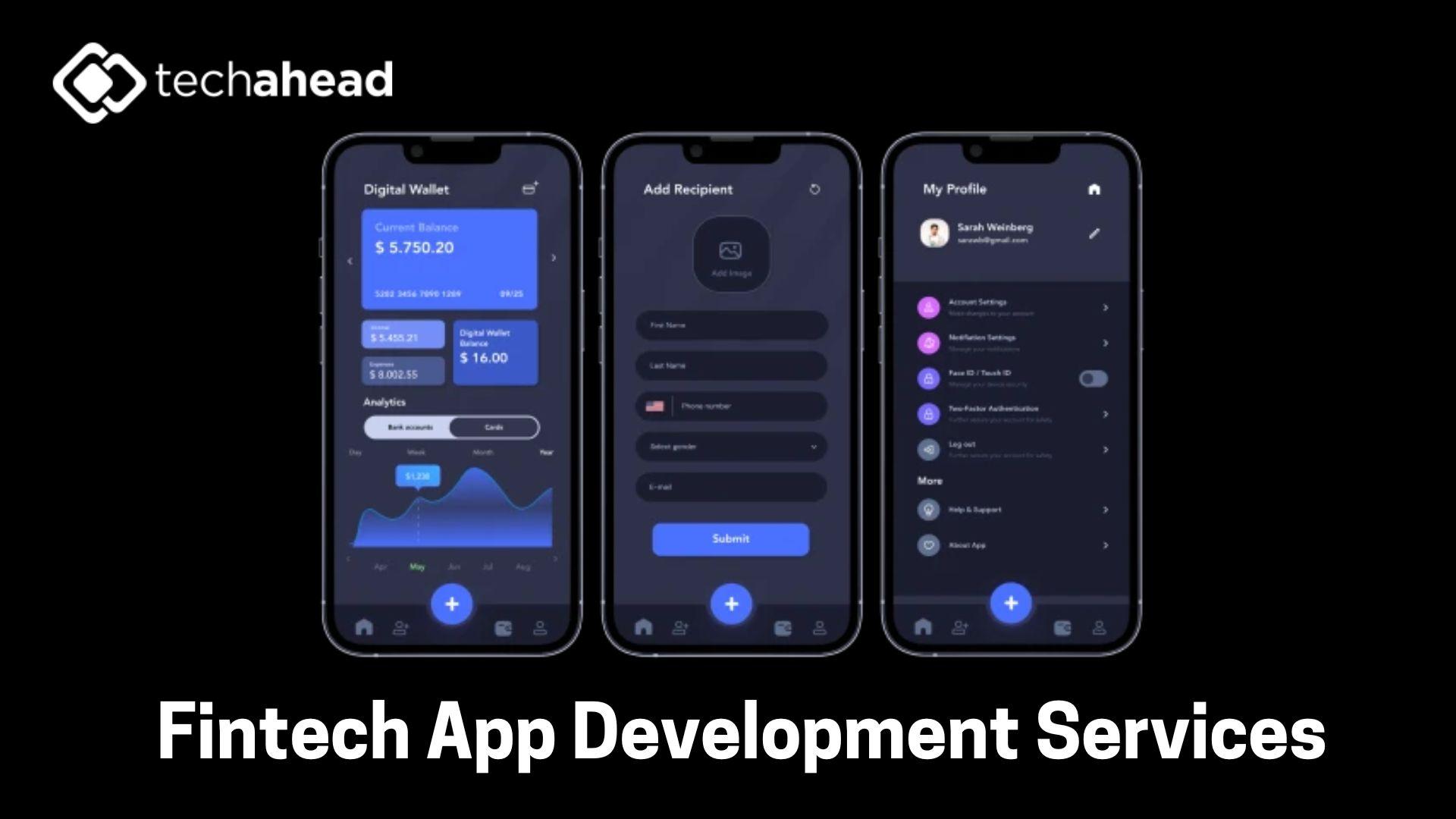

Ready to revolutionize the financial sector with a secure, scalable fintech app? Partner with TechAhead, a leading fintech app development company, AI app development company, and iOS app development company to bring your vision to life. Our team of expert developers, compliance specialists, and UX designers crafts cutting-edge financial solutions that drive innovation and trust.

Our Expertise:

🔹 AI-Powered Fintech Solutions – Predictive analytics, intelligent chatbots, and advanced fraud detection.

🔹 Blockchain & DeFi Integration – Secure, transparent, and decentralized transaction systems.

🔹 iOS & Cross-Platform Excellence – Build seamless, high-performance apps for iPhones, iPads, and beyond.

With a proven track record of delivering compliant, user-centric fintech apps, we ensure your solution not only stands out but thrives in a competitive market.

Let’s shape the future of fintech together—schedule a free consultation with TechAhead today

USA

Address: 28720 Roadside Dr, STE 254, Agoura Hills, CA 91301

Phone Number: +1 (818) 318-0727

Website: https://www.techaheadcorp.com/