Executive Summary

The global Iron Ore Mining Market remains the backbone of the global industrial economy, providing the essential raw material for 98% of world steel production. In 2024, the market was valued at approximately USD 290.25 billion and continues to be driven by massive infrastructure projects in emerging economies and the global transition toward "green steel" production. The industry is currently characterized by a strategic shift toward high-grade ores and the rapid integration of autonomous mining technologies to enhance operational efficiency and safety.

https://www.databridgemarketresearch.com/reports/global-iron-ore-mining-market

Market Overview

Iron ore mining involves the extraction of iron-rich minerals, primarily hematite and magnetite, which are processed into fines, lumps, and pellets. The market is highly concentrated, with a small number of "Tier 1" miners controlling a significant portion of the global seaborne trade. As of 2026, the industry is increasingly influenced by geopolitical dynamics and trade policies, alongside a profound push for decarbonization within the mining and metals value chain.

Market Size & Forecast

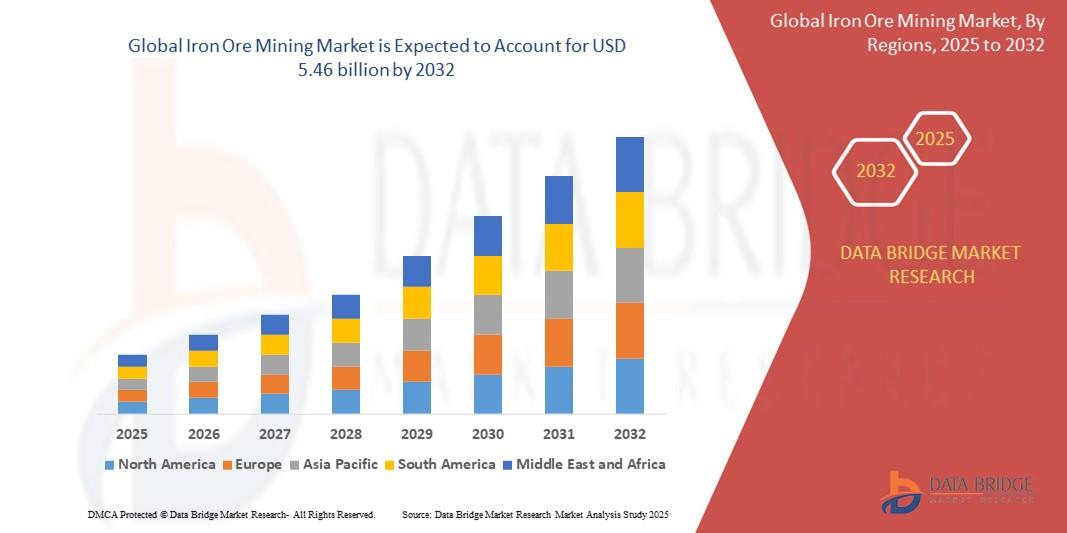

The global iron ore mining market is projected to reach a valuation of USD 397.98 billion by 2032, rising from USD 290.25 billion in 2024. This growth represents a steady CAGR of 4.0% during the forecast period of 2025–2032. While mature markets exhibit stable demand, significant expansion is expected from South Asia and Southeast Asia, where rapid urbanization and industrialization programs are driving historic levels of steel consumption.

Market Segmentation

The market is segmented to reflect the diverse physical forms of the ore and its critical end-use applications:

- By Product Type: Iron Ore Fines (Largest Segment), Iron Ore Pellets, Iron Ore Lumps, and HBI/DRI (Hot Briquetted Iron/Direct Reduced Iron).

- By Mining Type: Surface Mining (Dominant, approx. 75% share) and Underground Mining.

- By Grade: High-Grade (Fe >65%), Medium-Grade, and Low-Grade.

- By End-User Industry: Construction & Infrastructure (Dominant), Automotive & Transportation, Machinery & Equipment, and Shipbuilding.

Regional Insights

Asia-Pacific remains the dominant force in the market, accounting for over 72% of global demand. China continues to be the world's largest importer and consumer, though India is emerging as the fastest-growing regional market due to domestic infrastructure mandates. On the supply side, Australia and Brazil remain the premier exporters, with Australia's Pilbara region serving as the global hub for low-cost, high-volume production. North America is also seeing renewed investment in domestic mining to support localized supply chains for the automotive sector.

Competitive Landscape

The iron ore mining sector is characterized by high capital intensity and significant barriers to entry. The competitive landscape is dominated by a few global giants:

- Vale S.A.

- Rio Tinto

- BHP Group Limited

- Fortescue Ltd.

- Anglo American plc

- ArcelorMittal

- Cleveland-Cliffs Inc.

- NMDC Limited

https://www.databridgemarketresearch.com/reports/global-iron-ore-mining-market/companies

Trends & Opportunities

Decarbonization and Green Iron: There is a surging demand for high-grade ores and pellets suitable for Direct Reduced Iron (DRI) and Electric Arc Furnaces (EAF), which produce significantly lower carbon emissions than traditional blast furnaces.

Autonomous Mining and AI: Major players are deploying fully autonomous haulage systems (AHS) and AI-driven predictive maintenance to reduce operational costs. Opportunities also lie in "Digital Twins" of mines to optimize resource recovery and safety protocols in real-time.

Challenges & Barriers

The market faces volatility in commodity pricing, often triggered by shifting trade agreements and geopolitical tensions. Stringent environmental regulations regarding tailings management and water usage present high compliance costs. Additionally, "resource nationalism" in various jurisdictions can lead to export taxes and restrictive mining licenses, complicating long-term investment strategies.

Conclusion

The Iron Ore Mining Market is entering a new era defined by sustainability and technological integration. While the reliance on steel ensures long-term demand, the industry’s future leaders will be those who successfully navigate the transition to low-carbon extraction and adopt autonomous technologies to buffer against price volatility.

https://www.databridgemarketresearch.com/reports/global-iron-ore-mining-market

Browse Trending Report: Iron Ore Mining Market

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email: corporatesales@databridgemarketresearch.com